Jakob Bickley

University of Alberta Mathematics and Finance Student

Actively seeking full‑time opportunities in Finance, Insurance (Underwriting & Analytics), and Data Operations - available Jan 2026.

Education

CFA Level I Candidate (May 2026)

University of Alberta – BSc in Mathematics & Finance (Expected Jan 2026)

- GPA: 3.8

- Scholarships:

- The Cathy Allard-Roozen Leadership Award (2023)

- Louise McKinney Scholarship (2023)

- Thorleif M. Fostvedt Scholarship in Mathematics (2024)

- The I M May Denham Memorial Scholarship in Mathematics (2025)

Work Experience

Saskatchewan Government Insurance – Summer Underwriting Intern

- Supported commercial property and auto underwriting teams; liaised with brokers to improve quote accuracy and turnaround time.

- Built automated Excel tools to track premiums, quoting success, and broker KPIs-cutting manual reporting time by ~40%.

- Integrated Python/Selenium data validation flows and approved AI tools (LLMs) to streamline administrative workflows.

- Standardized intake checklists and quality controls to reduce rework and ensure complete submissions.

- Collaborated cross‑functionally to triage edge cases and document repeatable procedures for junior team members.

University of Alberta – Teaching Assistant (Calculus)

- Evaluated 1,200+ assignments weekly using consistent rubrics and quantitative grading checks.

- Delivered problem‑solving sessions; identified learning gaps and created targeted examples to improve outcomes.

- Provided structured feedback to instructors highlighting common errors and recommended syllabus clarifications.

University of Alberta – Residence Assistant

- Mentored and supported 45+ residents; recognized as RA of the Year (2024–2025) for leadership.

- Designed and executed monthly programming that increased engagement and academic performance.

- Mediated conflicts, coordinated with campus safety and housing teams during incidents, and maintained detailed reports.

- Promoted inclusion, wellbeing, and adherence to university standards through proactive communication and restorative practices.

Technical Skills

A quick snapshot of what I use to ship automation, analytics, and finance work.

Python

Data wrangling, web automation, and reporting pipelines

- Pandas

- NumPy

- Matplotlib

- Selenium (browser automation)

- PDF/Email parsing

- Regex

- Dataclasses

Excel & VBA

Rapid prototypes and robust ops tooling for end users

- Power Query

- PivotTables

- VBA automation

- Financial models

- Data validation

- Dashboard Creation

Data & Databases

Lightweight storage and integration for ops workflows

- SQL (read/write)

- Access

- SharePoint list flows

Finance & Risk

Domain expertise from insurance and math/finance coursework

- Underwriting support

- Pricing/quote tracking

- Variance analysis

- Risk metrics

- Backtesting basics

- Excel modeling

- Underwriting analytics

- Exposure analysis

- DCF Model

- Scenario Analysis

- Derivatives Pricing

- Fixed Income

Projects

Electricity Capacity & Risk Analysis

AESO capacity trends, renewables growth, and storage expansion (R + ggplot)

Alberta electricity comes from many sources. The AESO tracks generation capacity in Alberta by type, including generation capacity that is used for private industrial purposes (but excluding micro-generation). Recently there has been more solar and wind making up a larger portion of the capacity. For upcoming capacity, AESO’s connection project list with projects with set in-service (or decommissioning) dates was used to see a projection of the future evolution of the sector, though that does not necessarily signal they will be built. It is green projects, namely solar, that dominate the project list, and there is also a massive increase in storage projects, which are essential for a greener grid, as they can smooth out capacity over the course of the day. Another key thing to watch is that along with these generation projects, it lists about 22GWs of connections, mostly data centers, which couldn’t be accommodated currently.

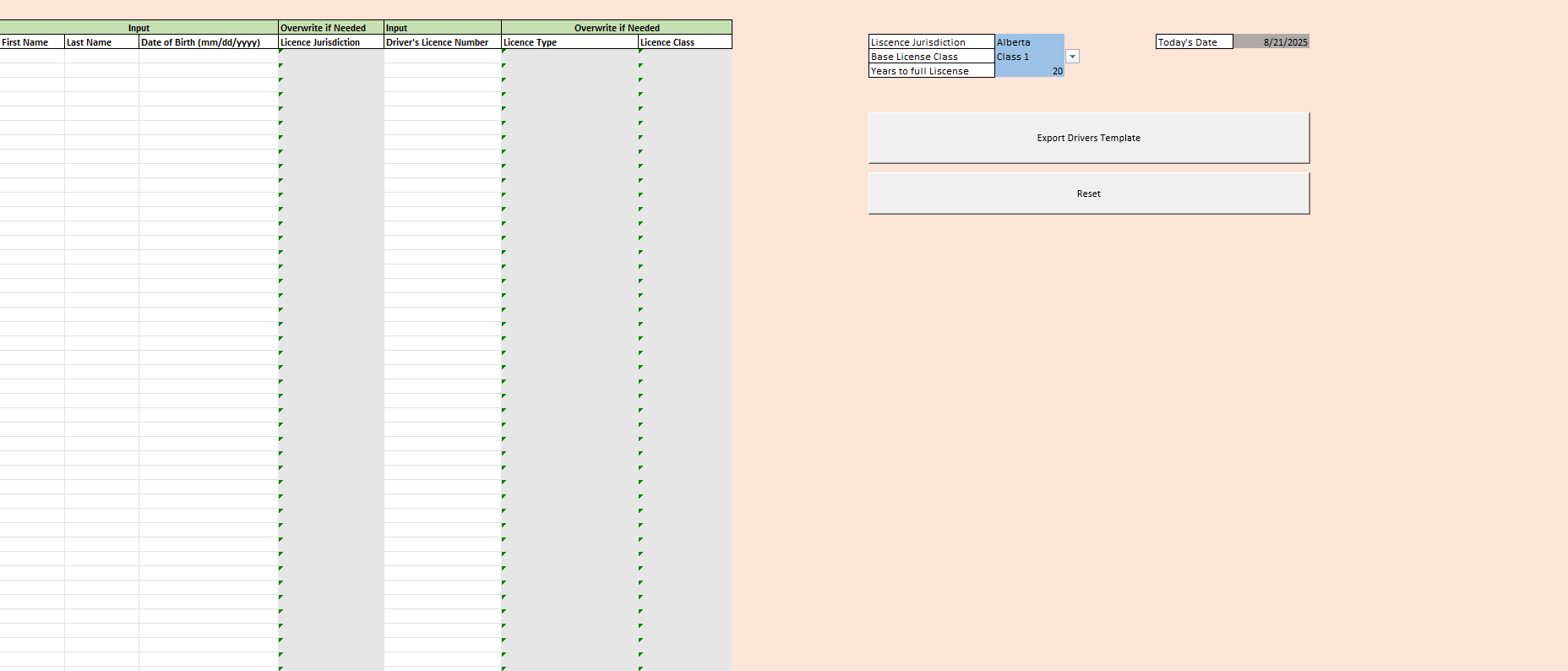

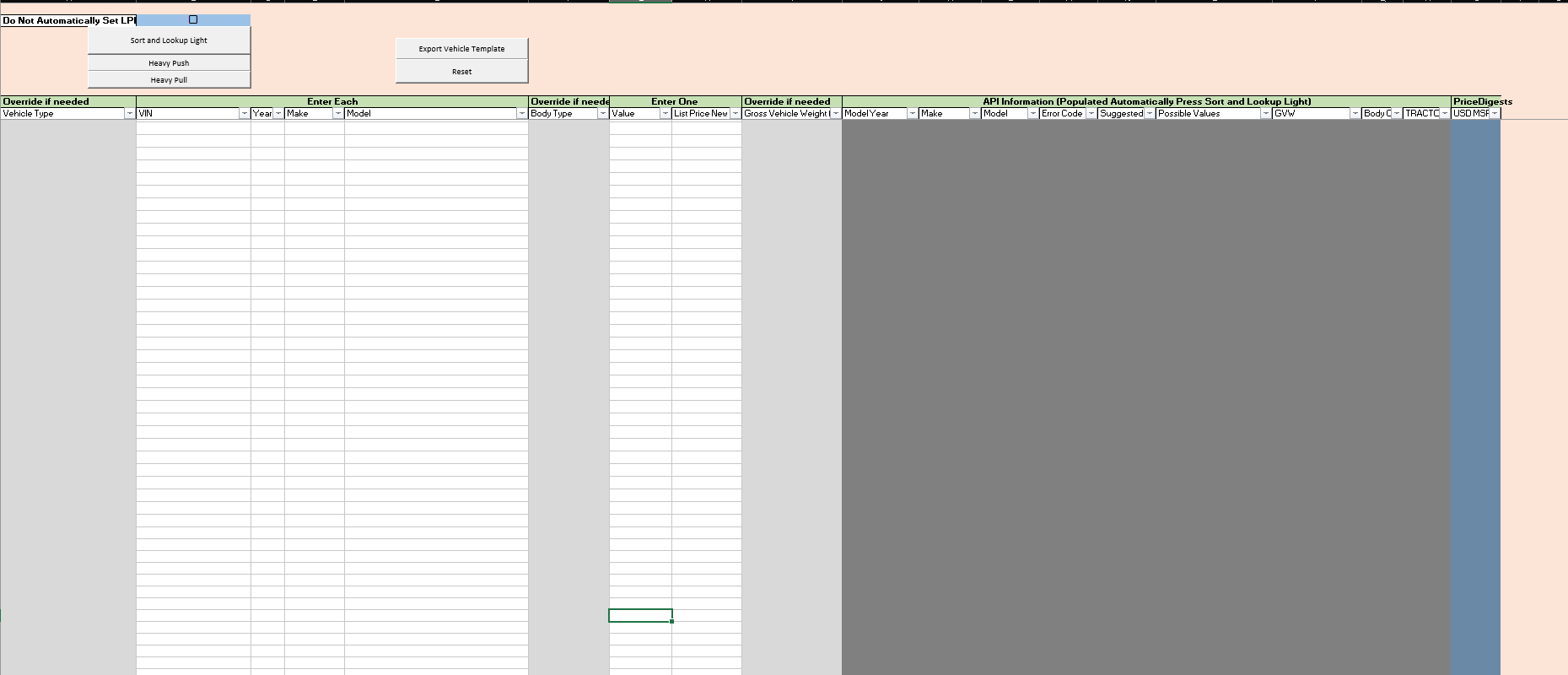

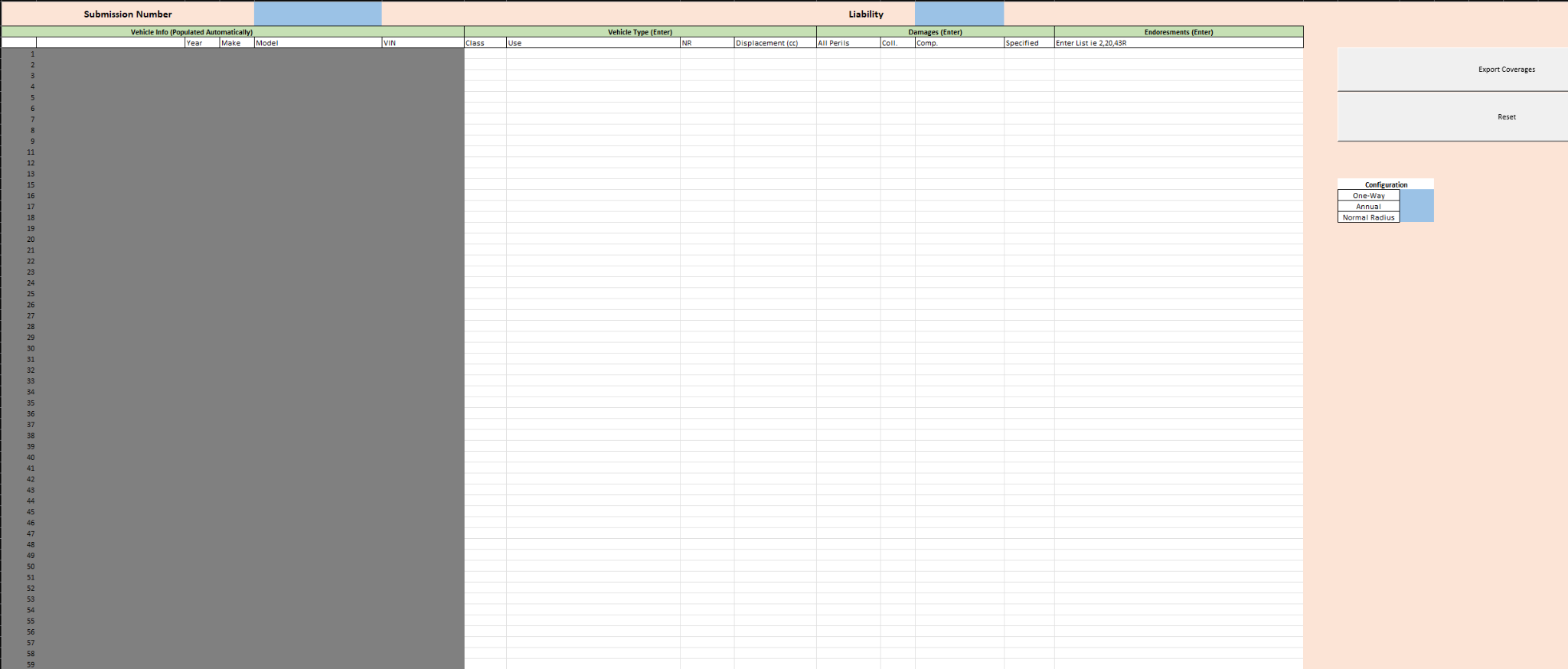

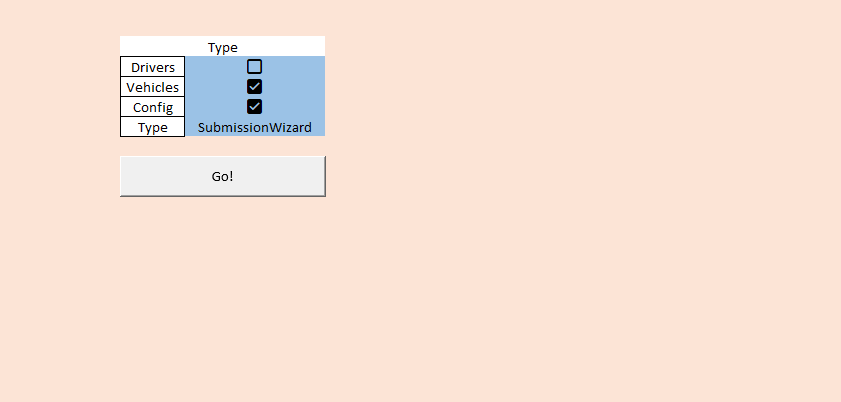

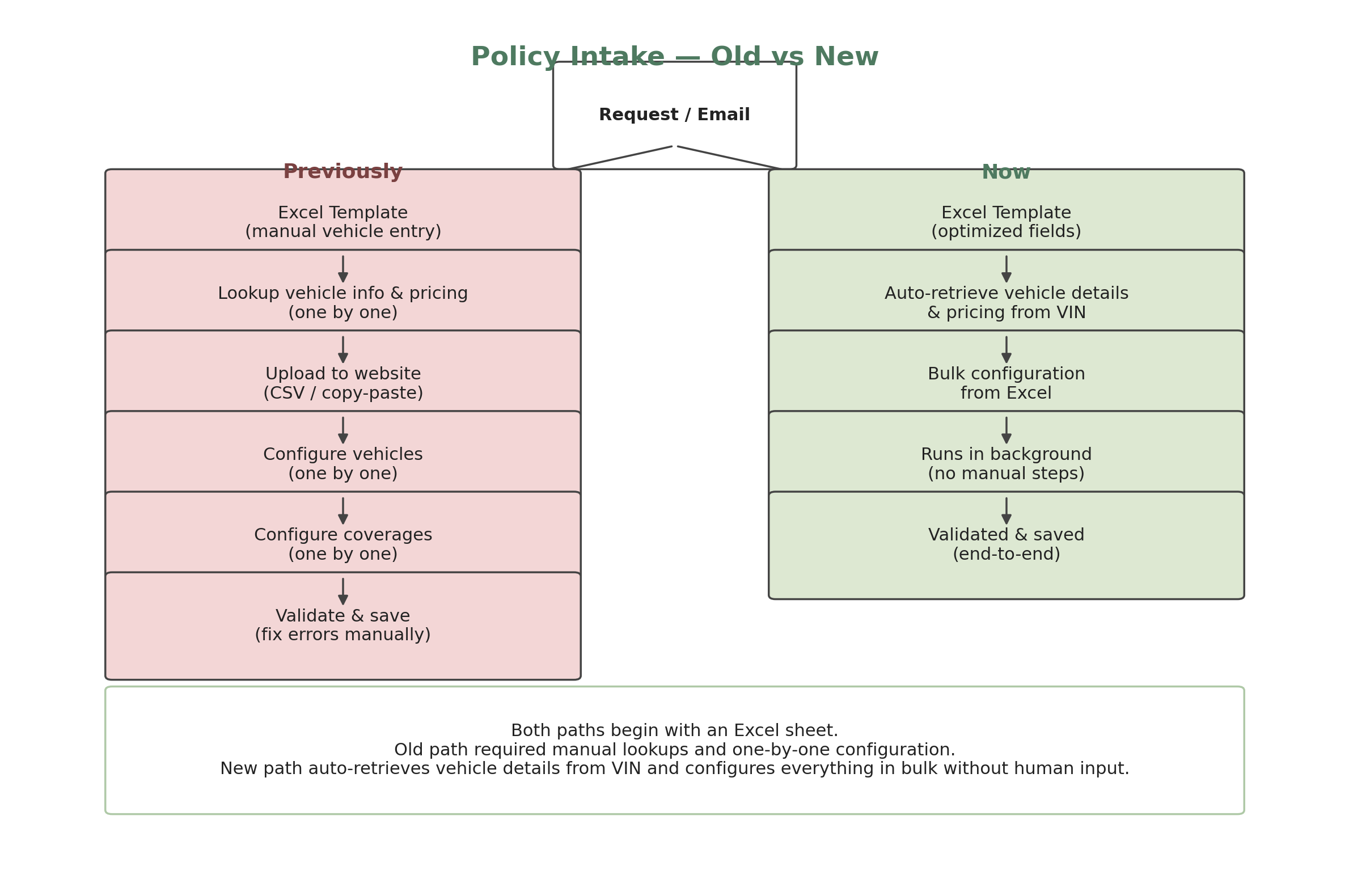

Excel‑Driven Guidewire Automation

Bulk vehicle & coverage configuration with automatic VIN lookups

This tool keeps Excel as the user interface while automating the heavy lifting in the background via a couple of python scripts. Users enter VINs (or VIN/Year/Make/Model); vehicle details and pricing are automatically retrieved from VINs where possible.; coverages and vehicles are configured in bulk and inputted a reliable manner using a Python Selenium runner. Result: faster intake, fewer manual clicks, and consistent completion of required fields all while allowing the user to complete other tasks. Note: This project is a component of the SGI Automation initiative.

Ongoing Project: Markov Bank Run Simulation

We are building a practical simulation of bank funding stress that a finance professional can read and interpret. The model blends a Markov chain for regime switches (calm vs. stressed liquidity), a jump-augmented Vasicek interest rate process to capture sudden rate shocks, and simple balance sheet flows for insured and uninsured deposits. Outputs will show how funding costs, deposit run probabilities, and fire-sale losses evolve over time so teams can stress test assumptions without heavy math notation. Visuals and scenario dashboards will be added as we complete the code and begin simulation runs.